The Black Friday-Cyber Monday week is typically the unofficial start of the holiday shopping season. With the sales figures often considered a sign of the overall economic health of the country and a way to measure how confident Americans feel about discretionary spending. But this year, there is a noticeable shift in mood as affordability dominates debates and households, and shoppers signaling that they may curb spending for the first time in several years.

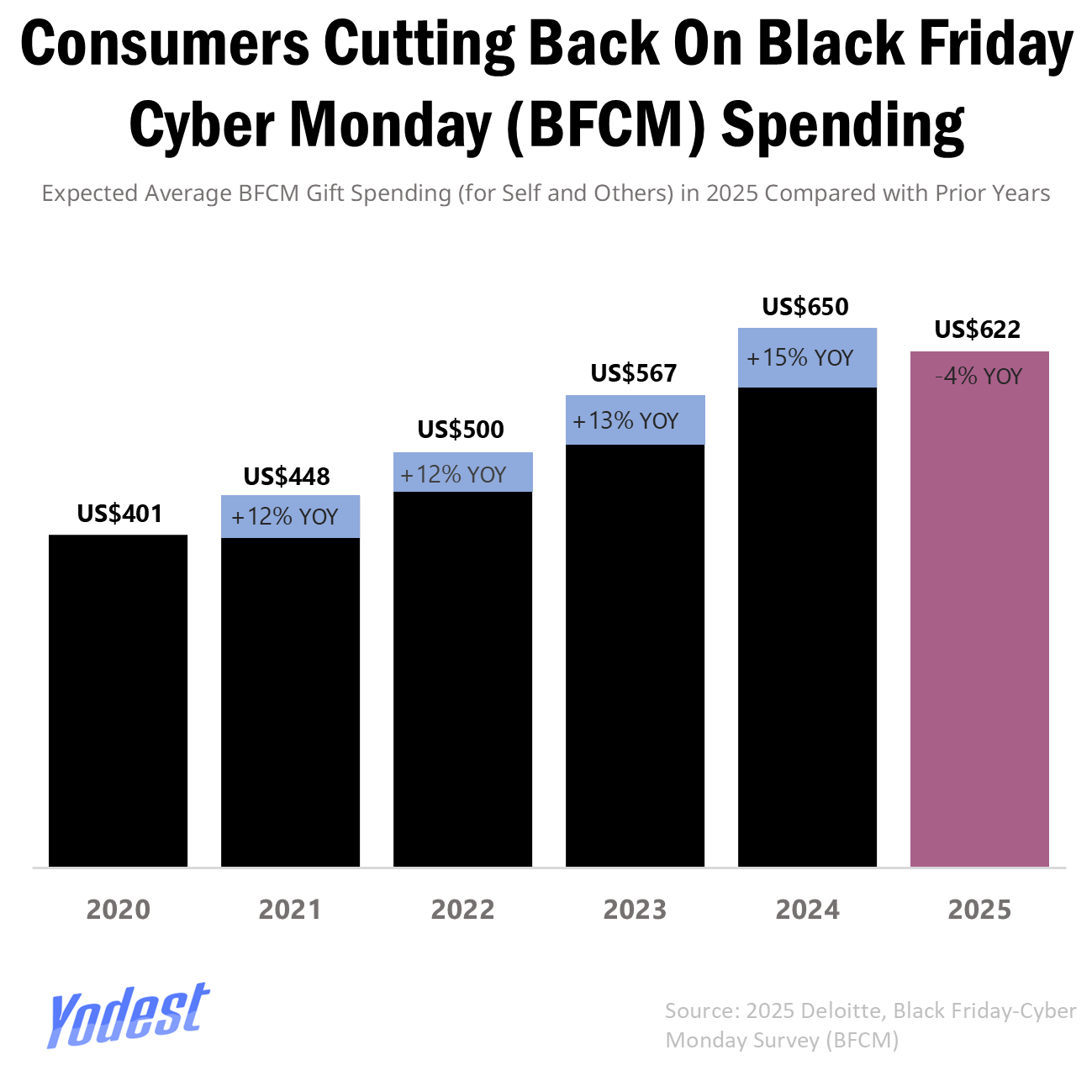

A new Deloitte survey shows that shoppers expect to spend an average of $622 from Black Friday through Cyber Monday, showing a 4.3% decline from 2024 and the first drop since tracking began in 2020. Gen Z is pulling back their purses the most, as PwC’s 2025 Holiday Outlook survey shows they expect to slash holiday budgets by 23%. In fact, 84% said they expect to reduce their spending over the next six months, pointing to rising prices, newly imposed tariffs, and the pressures of navigating early careers in an unstable job market. The same survey shows a dramatic shift in financial sentiment from the year prior, when that same age group planned to raise spending by 37% but now a quarter say their economic situation has worsened since 2024.

Even so, a downturn in overall spending does not necessarily translate into a quiet weekend for retailers. What it does mean is that consumers will probably put their budgets toward places they believe offer the strongest value. On that note, Walmart has rolled out discounts of up to 50% across categories ranging from tech to furniture and fashion, while Best Buy has pushed select electronics to more than 60% off, and Target has distributed deals across multiple departments. Higher-income households remain the only group projecting an increase in spending, with those earning $199,000 or more planning to spend 5% more than last year.

Mastercard SpendingPulse expects a 3.6% increase in holiday sales from November 1 through December 24, compared with 4.1% a year earlier. Clearly, there's uncertainty," Mastercard Chief Economist Michelle Meyer noted, adding that “consumers feel on edge. But at the moment, doesn't seem like it's changing how they are showing up for this season”.

A BNPL-powered holiday

Underlying the spending restraint is a growing dependence on short-term credit. A PayPal survey finds that half of all U.S. shoppers plan to use “buy now, pay later” services this holiday season, reflecting how deeply BNPL has established itself into everyday consumer behavior. One in four millennials and Gen Z-ers use services like Affirm or Klarna regularly, as they navigate through overdue student loan bills, higher grocery prices, and unstable income. Although BNPL plans seem to offer the convenience of zero-interest installments or easy enrollments, it becomes a cycle of loan stacking, late fees, and high interest rates.

Meanwhile, the U.S. credit-card debt reached $1.2 trillion in Q3 2025 and is projected to rise further as holiday purchases accumulate. Scott Wren, senior global market strategist at the Wells Fargo Investment Institute, points out that the most significant financial strain is concentrated among lower-income households, which have seen their debt loads climb while their purchasing power has failed to keep pace with inflation. Because these families already spend most of what they earn on basic necessities, any additional pressure leaves almost no room for discretionary purchases, thus widening the gap between shoppers who can still participate in the holiday season and those who are now being pushed out.

Economists are even warning that this precarious situation is beginning to resemble the early rumblings of the subprime mortgage crisis, a similar slow-burn that ultimately led to the Great Recession.