Hi! It feels like we made it to the shortest month of the year in a rather short span. Almost as quick as it takes for you to pet your neighborhood golden retriever on sight. So, how about reading out some fun facts related to our snuggle buddies:

Grins With The Chin: Golden retrievers can physically pull back their lips into a relaxed smile, when they feel content.

America’s Emotional Support: The breed consistently ranks as top 3 most popular U.S. breeds, making it one of the go to choice for dog-owners.

A little token for our adorable couch-friendlies, to celebrate National Golden Retriever Day. So, don’t shy away from letting your pet munch on some extra treats on today’s occasion, and now let’s get started with our data stories!

Today’s special:

Pricey Uninterrupted Listening : Spotify has increased the subscription prices yet again?

Influenzial Coughing Season: Why is everybody at work & home sick with the Flu all of a sudden-

Chinese Mineral Water: Major American mineral import data insights as well as subservience!

Wrapped In Spotify’s Subscription

Spotify’s price hikes are piling up just as Americans feel subscription fatigue. What was once the poster child for cheap, all-you-can-stream music is starting to feel… expensive. The streaming giant announced it will raise its U.S. Premium plan to $12.99 per month starting in February 2026. This marks the third price increase in three years for U.S. users. This jump also affects other plans with Duo rising to $18.99 and Family to $21.99. That shift matters because Spotify spent more than a decade training users to believe streaming should cost about ten bucks. That psychological anchor has held since its inception even as the price drifts away from it. Yet here’s the conundrum: people keep on paying.

Regardless of these price moves, Spotify’s user base still shows resilience. In Q3 2025, Premium subscribers grew 12% year-over-year to 281 million paying users, while monthly active users hit 713 million globally. This signaled the existence of retained demand even with rising costs. In addition, the company also reported robust profitability with operating income generating €582 million ($680 million) for the quarter.

Melody of Misfortune

Spotify’s growth masks an underlying consumer frustration that hasn’t eased down. Many longtime listeners are reminiscing about how Spotify's U.S. Premium plans used to be. When it stayed at $9.99 for over a decade, with only incremental hikes in 2023 moving first to $10.99 and then $11.99 before the latest rise. The cumulative effect is now a 30% increase in price in under three years, raising questions about the perception of value. The contrast between subscriber growth and price sensitivity is exacerbating the situation. Spotify added millions of paying subscribers over 5 million new premium users in Q3 2025 alone but users’ sentiment on this remains divisive. The higher prices aren’t doing a good job at justifying what it offers when it hasn’t changed in terms of music discovery or audio quality.

Meanwhile it would be remiss not to mention that the competitive landscape is shifting. Users are already looking for alternatives like Apple Music, Tidal and YouTube Music that operate at the price of $10.99/month. Spotify’s jump to $12.99 per month is persuading cost-conscious listeners to reassess their streaming dollars.

Flowing With The Flu

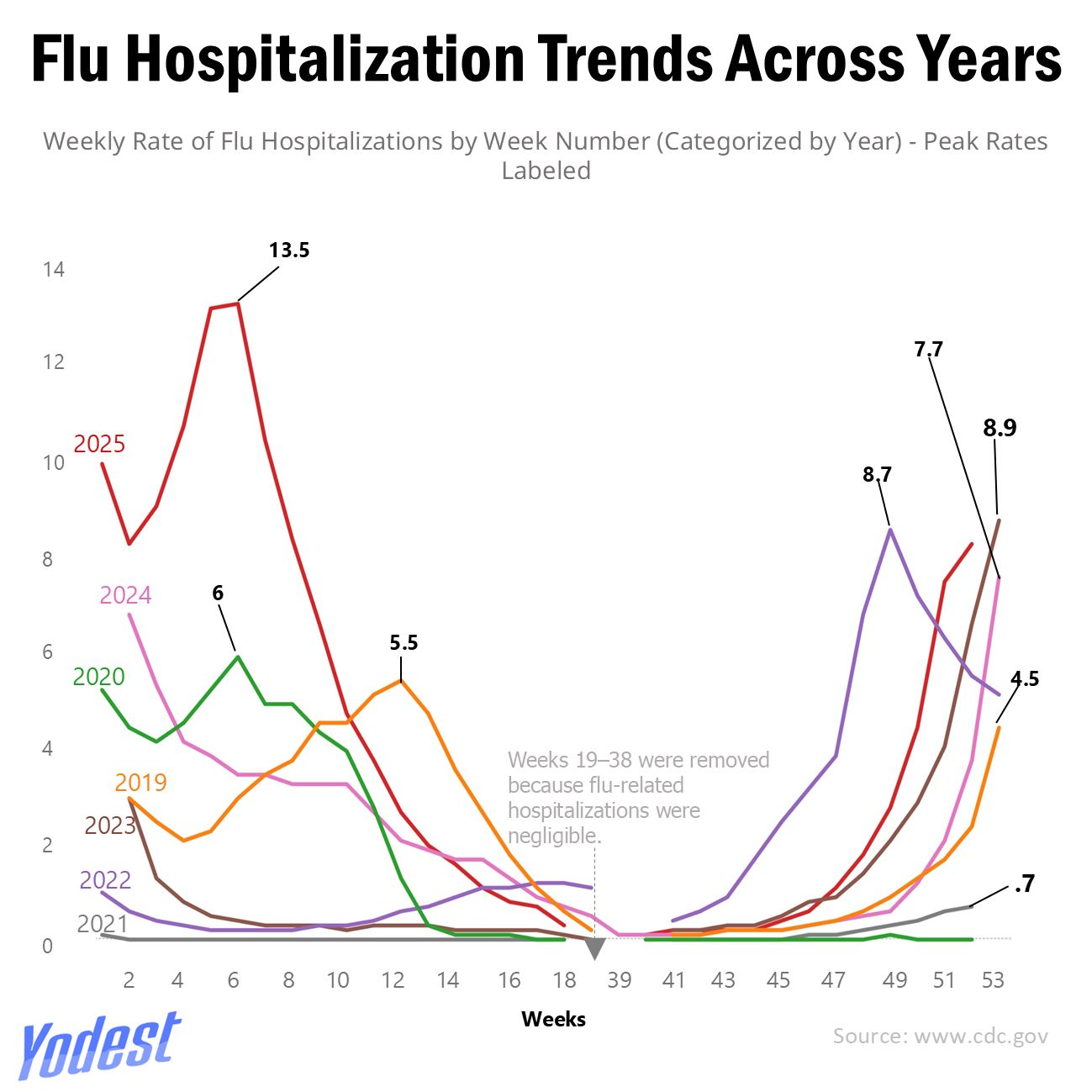

As the 2025–26 flu season unfolds, public health data show the United States is experiencing exceptionally high influenza activity, prompting comparisons with the most severe seasons of the past decade. As per the CDC’s FluView surveillance report for the ending week of December 2025, flu activity has been elevated on a national scale, with over 81,000 hospitalizations, already recorded this season, figures that accentuate a serious outbreak well above typical early-season levels. Influenza A viruses, particularly the H3N2 subtype and its subclade K variant, constitute the majority of this circulation, making up roughly 91.8% of subtyped viruses. Elevated flu activity is widespread, with most states reporting increased outpatient visits for flu-like illness above baseline and influenza present in approximately 25.6% of tested specimens.

Many experts attribute the dire situation of this current outbreak and its intensity to partial mismatch between circulating strains and vaccines available currently, which in turn has lowered overall vaccination coverage, and in prevention of the high transmissibility of subclade K.

Coughing On Steroids

According to CDC estimates reported by NPR, there have been at least 7.5 million illnesses and 3,100 deaths so far, and cases were expected to continue rising into January. That pattern is echoed in NBC News reporting on CDC data, which shows flu has surged nationwide: nearly 1 in 10 outpatient visits (8.2%) were due to flu-like illness by the week ending Dec. 27, the highest rate of doctor visits for these symptoms in nearly 30 years, and at least 5,000 people have died this season, including nine children. This surge isn’t confined to one region. New York reported a record of 4,546 flu-related hospitalizations marking its highest weekly total ever with an estimate of over 72,133 new cases in a single week, the most since state tracking began in 2004. Moreover, this strain isn't just a coast-to-coast phenomenon; Colorado is among states seeing significant surges in cases and hospitalizations, setting a weekly hospitalization record with 791 flu patients reported.

Low vaccination uptake is compounding concerns. Data shows flu vaccination among U.S. children and teens has dropped to 43%, down from 63.7% pre-pandemic, while coverage among adults who are 65 and older has slipped to just under 66%, leaving a majority exposed as hospital admissions surge. The upshot is quite stark: even as shots offer reduced protection against H3N2 subclade K, most Americans are confronting the dominant strain with no vaccine help at all.

America’s Mineral Drought

America’s energy and tech future hinges on a set of raw materials most consumers barely think about, rare earth elements like lithium, cobalt, graphite, nickel, vanadium and manganese. But unlike oil, U.S. supply chains for these critical minerals are dangerously fragmented. According to the Environmental and Energy Study Institute, in 2024 the U.S. was 100% import-reliant for 12 critical minerals, and it was more than 50% import-reliant for an additional 28 minerals on the list making the country uniquely vulnerable to external disruptions. That pressure becomes quite visible in trade data. Visual Capitalist shows the U.S. heavy reliance on imports, with more than 100% import dependence for elements like manganese and fluorspar, materials which are essential to batteries, semiconductors, and defense systems. For graphite, a core EV battery input, U.S. import reliance also sits at 100%, rendering manufacturers exposed to even minor export disruptions.

The dependency extends well beyond rare-earth headlines. Antimony is 85% import reliant with 54% coming from China, and bismuth which is 89% reliant versus 60% China imported, these remain critical inputs for electronics, and energy systems. Even industrial materials often overlooked such as aluminum oxide which is at 95% reliance, with 61% from China and silicon carbide sits at 69% reliance. This accentuates how deeply embedded Chinese supply is across U.S. manufacturing value chains.

Going For The Jugular

China looms large in this landscape not because it supplies most U.S. imports, but because it controls the choke points that matter most. Macquarie’s modelling shows that while Chinese minerals make up about $2 billion, or roughly 3% of total U.S. critical mineral imports, the U.S. remains around 80% import-reliant for rare earth compounds and metals, with nearly 70% of those volumes sourced from China. That concentration creates outsized risk: export controls on just four rare earths: samarium, lutetium, terbium, dysprosium could cut more than $1 billion from the U.S. GDP in a single year. This effectively bottlenecks the entire supply chain regardless of where the ore is mined, this leverage translates into an economic risk. Demand itself isn’t slowing either. Critical minerals are essential inputs for clean energy technologies from lithium, nickel, and cobalt in EV batteries to rare earth elements in permanent magnets for wind turbines and materials in solar panels illustrating how the energy transition drives sustained demand for these raw materials.

America’s mineral insecurity is structural and increasingly visible. With demand accelerating and supply chains tightly concentrated, small policy shifts can trigger outsized economic shocks.

Extra Data Bites

Guess The Bites

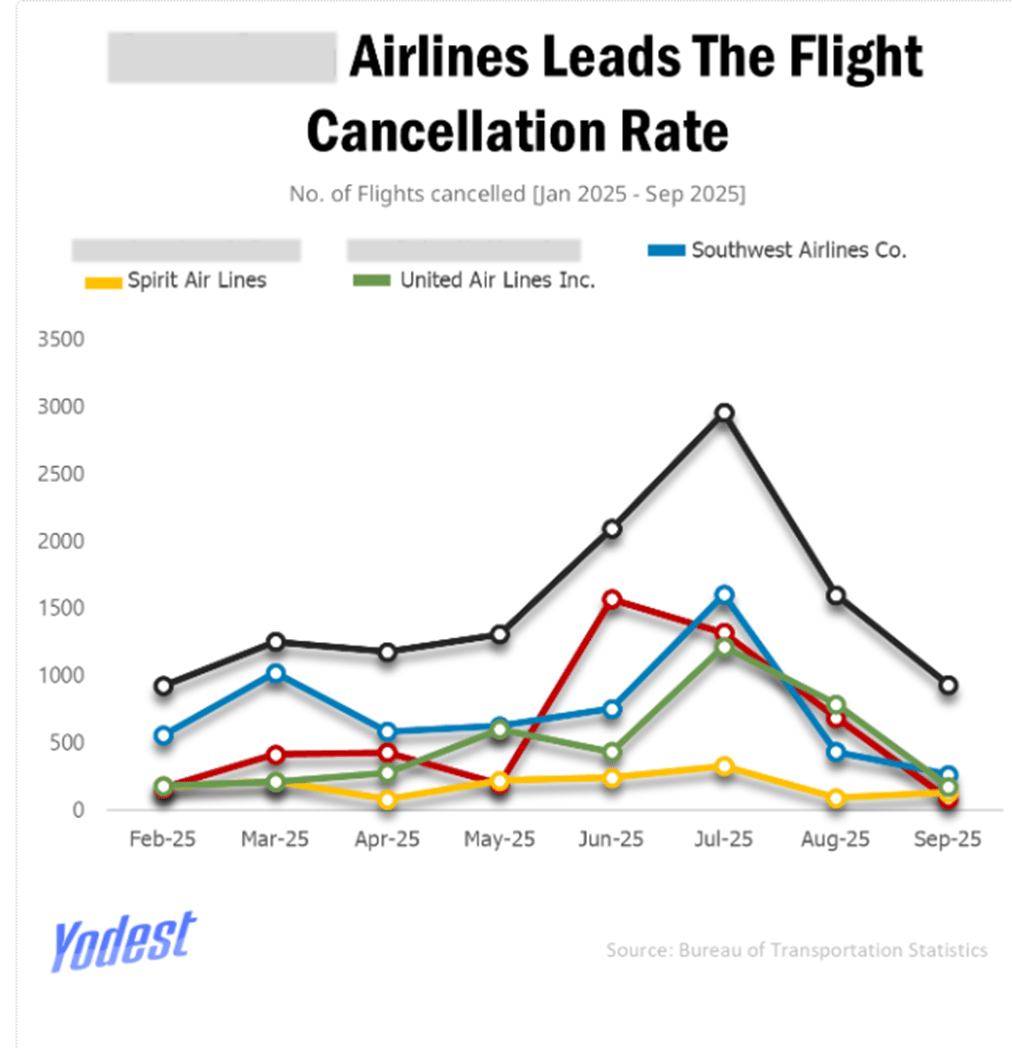

Which airline canceled the most flights last year?

[Answer Below]

Feel free to share your feedback, or share any topic suggestions that you want us to cover!

Want some more data stories?