A quieter quarter

On Oct. 23, Target said it would lay off 1,000 corporate employees and close 800 open roles — cuts that together affect roughly 8% of its global corporate workforce. The move came as Target reported sluggish sales and slumping profits in its fiscal third quarter, with inflation-weary shoppers pulling back on apparel and other discretionary items. The retailer also fell short of Wall Street expectations, and its outlook for the final stretch of the year disappointed analysts. “We encountered some unique challenges and cost pressures that impacted our bottom-line performance,” CEO Brian Cornell said.

On Nov. 19, Target reported third-quarter net sales of $25.3 billion, down 1.5% from 2024.

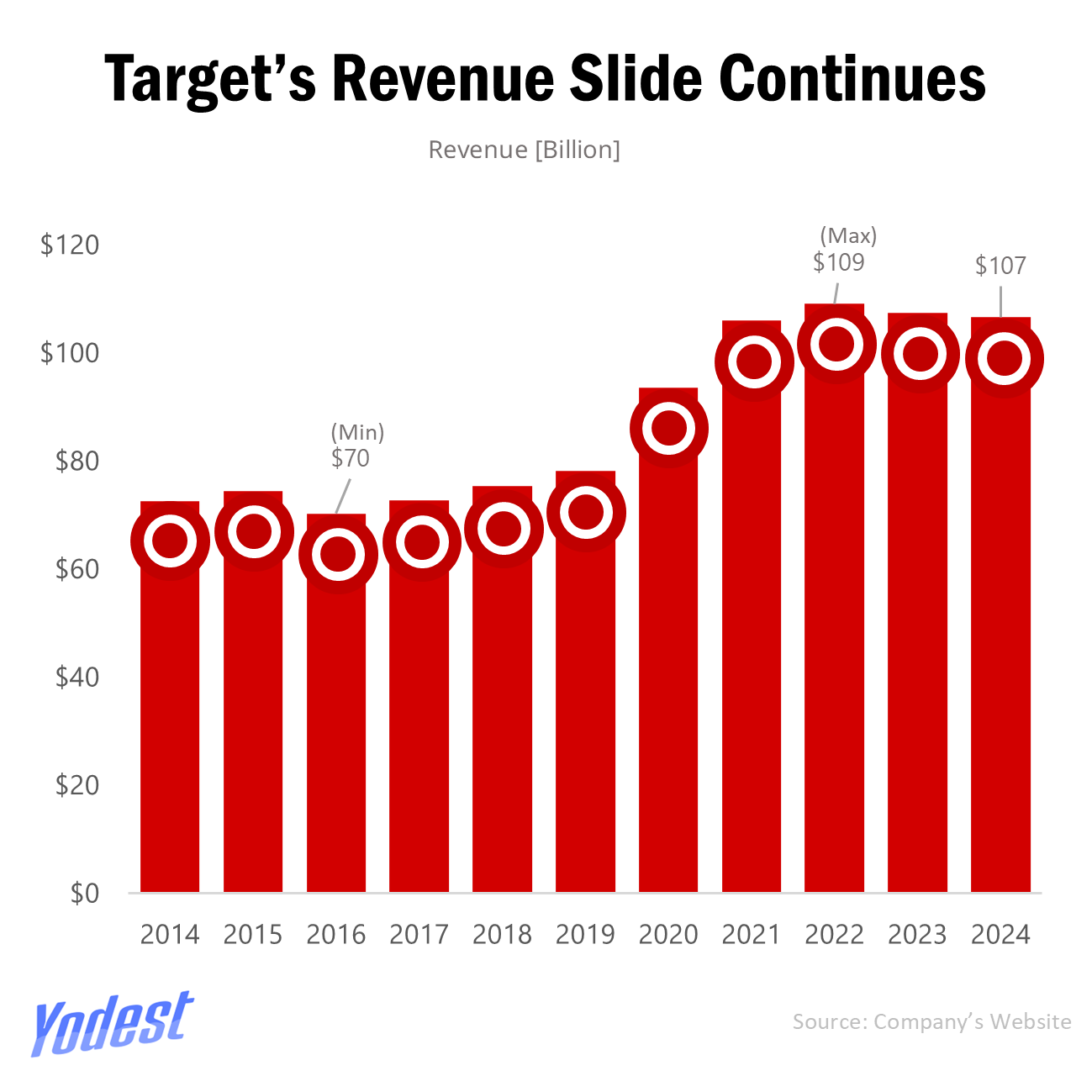

The company’s stock plummeted more than 21%, while Walmart’s rose nearly 3% after posting its own results. The contrast has rarely been sharper. Walmart, with its nearly 5,000 U.S. stores and $611.3 billion in annual sales, continues to thrive on scale and its long-running everyday low prices (EDLP) strategy. Target, by comparison, operates 1,900 stores and generated $107.4 billion in sales in its latest fiscal year.

Target’s rollback of certain DEI programs earlier this year sparked renewed calls for shoppers to stay away, and on Feb. 28 the company lost $12.4 billion in market value, according to The Charlotte Post. The current administration’s proposed sweeping tariffs on imports could also force retailers like Target to either absorb higher costs or pass them on to customers — the latter being especially risky amid already cautious consumer spending.

Even so, Target is trying to deliver a fresh holiday pitch and trying to win back holiday shoppers with a value-heavy lineup — including 20,000+ new items (twice as many since last year, with more than half exclusive), Thanksgiving meals under $20 with turkey at 79 cents per pound, and lower prices across thousands of essentials. The retailer is also pushing affordability with gifts from $5 and toys under $20, supported by expanded next-day shipping that now reaches over half of the U.S.

A pricey reset

The company plans to increase capital spending by 25%, amounting up to $5 billion next fiscal year to upgrade its supply chain, digital systems and in-store experience. Incoming CEO Michael Fiddelke who replaces Brian Cornell on Feb. 1 after Cornell’s 11-year run — said the retailer must act decisively. “We’re acting with urgency to make the changes and investments to position Target for sustainable and profitable growth,” he told analysts.

Target is also partnering with OpenAI to let customers shop on Target through ChatGPT, part of a push to modernize its digital storefront.

The road ahead

Turning around a 19% profit slide is now Fiddelke’s first major test. Perhaps Target needs not only better cost control but also a refreshed brand identity to revive its reputation as a source for “affordable but stylish” goods, especially as Walmart upgrades its own stores, apparel, and assortment. With inflation fatigue, political boycotts, higher tariffs, and industry-wide caution, Target’s turnaround hinges on whether new investments translate into renewed consumer trust.

BEFORE YOU GO

Not all news. Just the news that matters and changes the way you see the world, backed by beautiful data.

Takes 5 minutes to read and it’s free.