The coin that bleeds

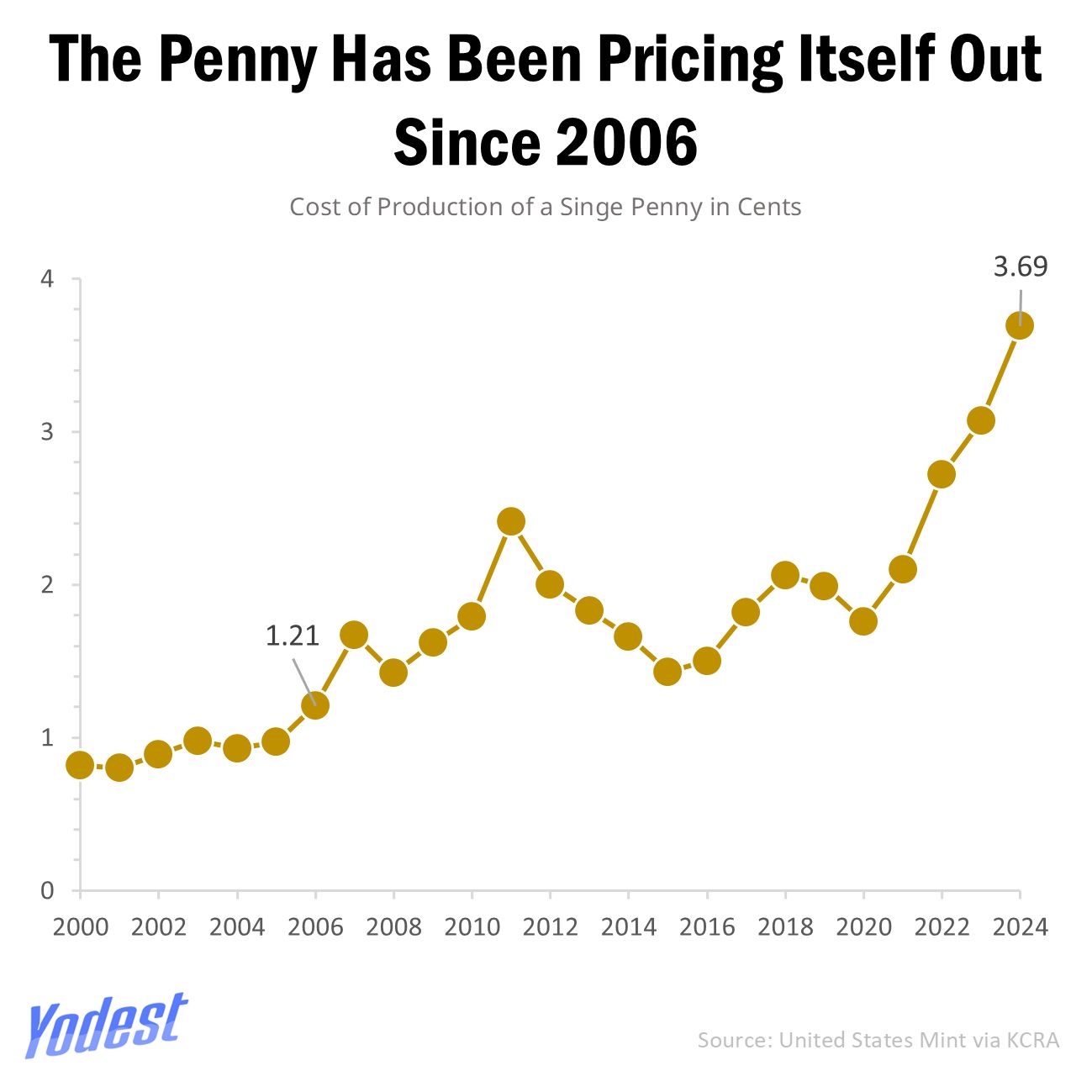

The US Penny has officially become a fiscal black hole in the economy. It now costs 3.69 cents, four times its face value, to mint one penny. For a while, the Government has been mired in textbook negative seigniorage, incurring a colossal $85.3 million loss when producing nearly 3.2 billion pennies in 2024 alone. Zoom out, and the move from afar looks much worse. Total production is at a height of $117 million, while the value of pennies produced was merely $31.7 million.

Beyond its financial burden, the process of mining and minting exerts substantial environmental and production costs. President Trump’s directive to stop minting new pennies accelerates the shift, as shortages shockwaves through the country. With production halted, thousands of retailers are unable to source pennies, even affecting McDonald’s locations caught without change. The bottleneck is structural; nearly two-thirds of about 165 Federal Reserve terminals have stopped the distribution of pennies, with 250 billion pennies in the system. It isn’t just uneconomical; the penny is an operational deadweight.

The rounding effect

With production tapering off, the cash total will most likely round to the nearest nickel and since there’s no federal legislation in place, it will render retailers and the tax system in limbo. Retiring the Penny ushers the US into uncertainty, and the economics show the stakes clearly. Its removal would put consumers in a predicament of facing a $6.06 million rounding cost annually based on the current cash usage patterns. Conversely, if the penny and the nickel were to be displaced, then this financial strain would swell to $55.58 million. Usage of cash has already wound down to 16% of transactions in 2024, so most Americans won’t be affected by the shift. But for households that are cash-reliant and have low incomes, this spells bad news.

Countries like Canada and Australia have successfully retired their smallest coins with minimal inflation or consumer backlash. Making it clear that rounding can be handled more finesse if the rules are clear from the start. The penny isn’t just declining, it’s dragging the system down with it. The data points to a bigger shift: the U.S isn’t just retiring a coin; it has beckoned in a new epoch of cash economics.