By late 2025, U.S. households were ending the year with unprecedented debt and mortgage balances accounted for a massive portion of it. Total household debt rose to a staggering $197 billion in the third quarter of 2025, bringing the aggregate to $18.59 trillion. Wherein mortgage balances alone accounted for $13.07 trillion. At the same time, newly originated home loans totaled $512 billion. It’s safe to say, borrowing wasn't slowing down even as financial pressure kept on piling up.

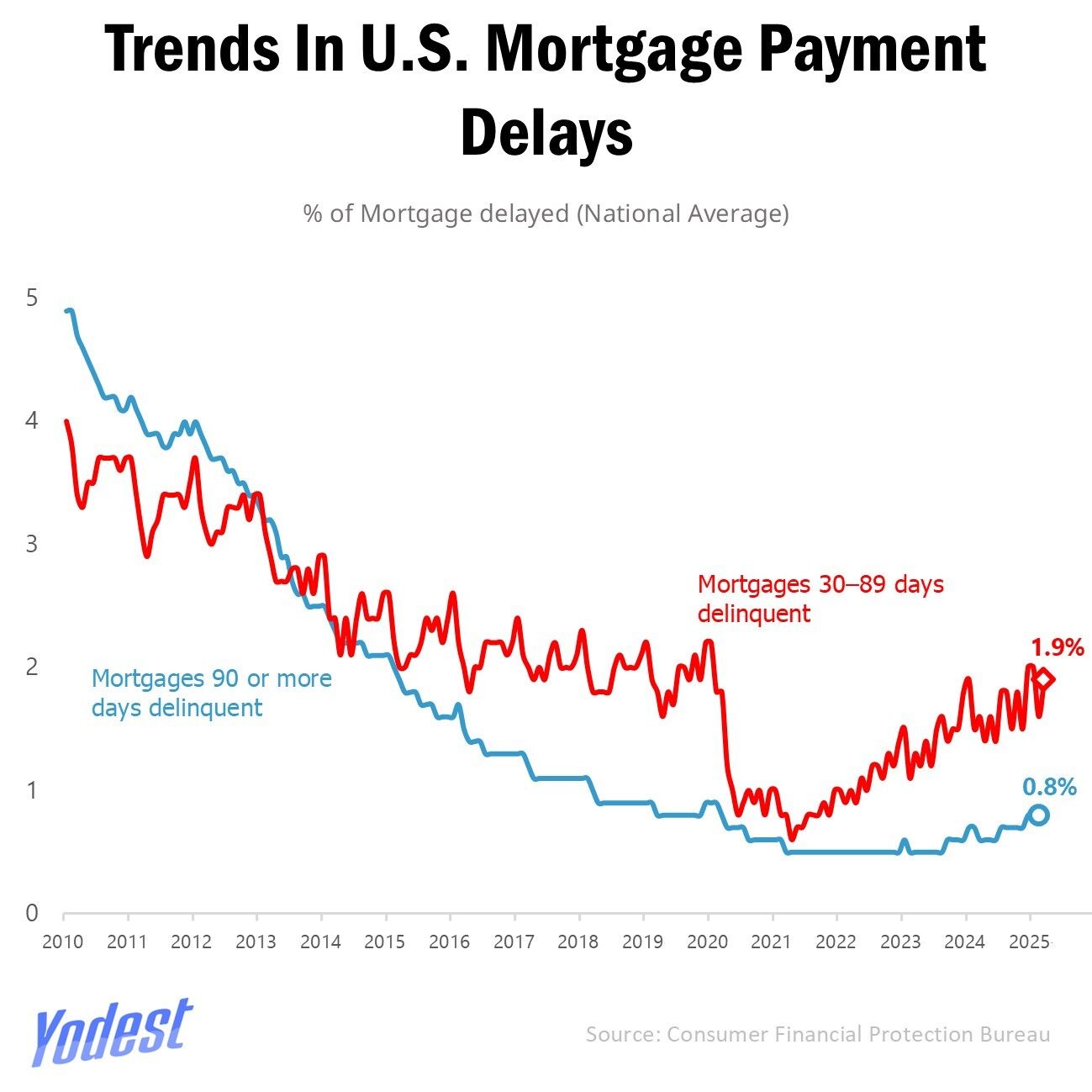

Debt isn’t just growing, it’s becoming harder to manage. In Q3 2025, mortgage delinquency rates, rose to 3.99% of all outstanding residential loans. That includes the number of mortgages that were at least 30 days past due, including foreclosure, which was at 2.9%. 104 out of 384 U.S. metropolitan areas posted an annual increase in their overall delinquency rate. While still far below crisis-era peaks, early-stage mortgage stress has re-emerged, with mortgages 30–89 days delinquent rising to 1.9% by 2025, alongside an increase in 90-day-plus delinquencies to 0.8%.

What’s driving these pressures is more than just the size of the debt. Rising costs outside of housing including property taxes that are 15.4% higher than pre-pandemic levels, have eroded the financial buffer many homeowners once relied on, particularly in states hit by natural disasters, where insurance costs have spiked and incomes lag.

A herculean debt

The broader picture from the New York Fed accentuates the scale and gravity of the challenge. In the third quarter of 2025, delinquency rates across all household debt types remained elevated at 4.5%, with mortgage originations rising yet only partially offsetting the rising burden of payments. Meanwhile, mortgage balances chugged along and grew by $137 billion in a single quarter, surpassing other forms of consumer credit.

Americans aren’t just struggling with bigger mortgage payments; they’re slipping behind across the broader credit landscape. In Q3 2025, mortgage delinquencies sat around 3.76% while other obligations were far more circumstantial. For student loans, delinquencies reached about 9.4%, and credit card delinquency in the lowest-income ZIP codes topped at 20.1% (90+day).

This patchwork of rising late payments amid receding inflation proves the points of how fixed costs, essential expenses, and competing debt obligations are pushing many borrowers closer to the edge of financial distress. With mortgage balances now making up the largest share of total consumer debt, a rising share of Americans find themselves stretched beyond historical norms.

BEFORE YOU GO

Not all news. Just the news that matters and changes the way you see the world, backed by beautiful data.

Takes 5 minutes to read and it’s free.