It's the most wonderful and expensive time of year, but many Americans are feeling anything but warm and fuzzy about the economy this holiday season. Affordability is weighing heavily on consumers’ minds amidst inflation, increased wages and tariffs. The latest CNBC All-America Economic Survey found that 61% of Americans believe prices are rising faster than their incomes, for 74% among those earning between $30,000 and $50,000 a year and 78% among those making $30,000 or less. It is against this backdrop, 41% of Americans say they plan to spend less this holiday season, while 42% expect to spend about the same, while less than half plan to spend more.

A bigger season every year

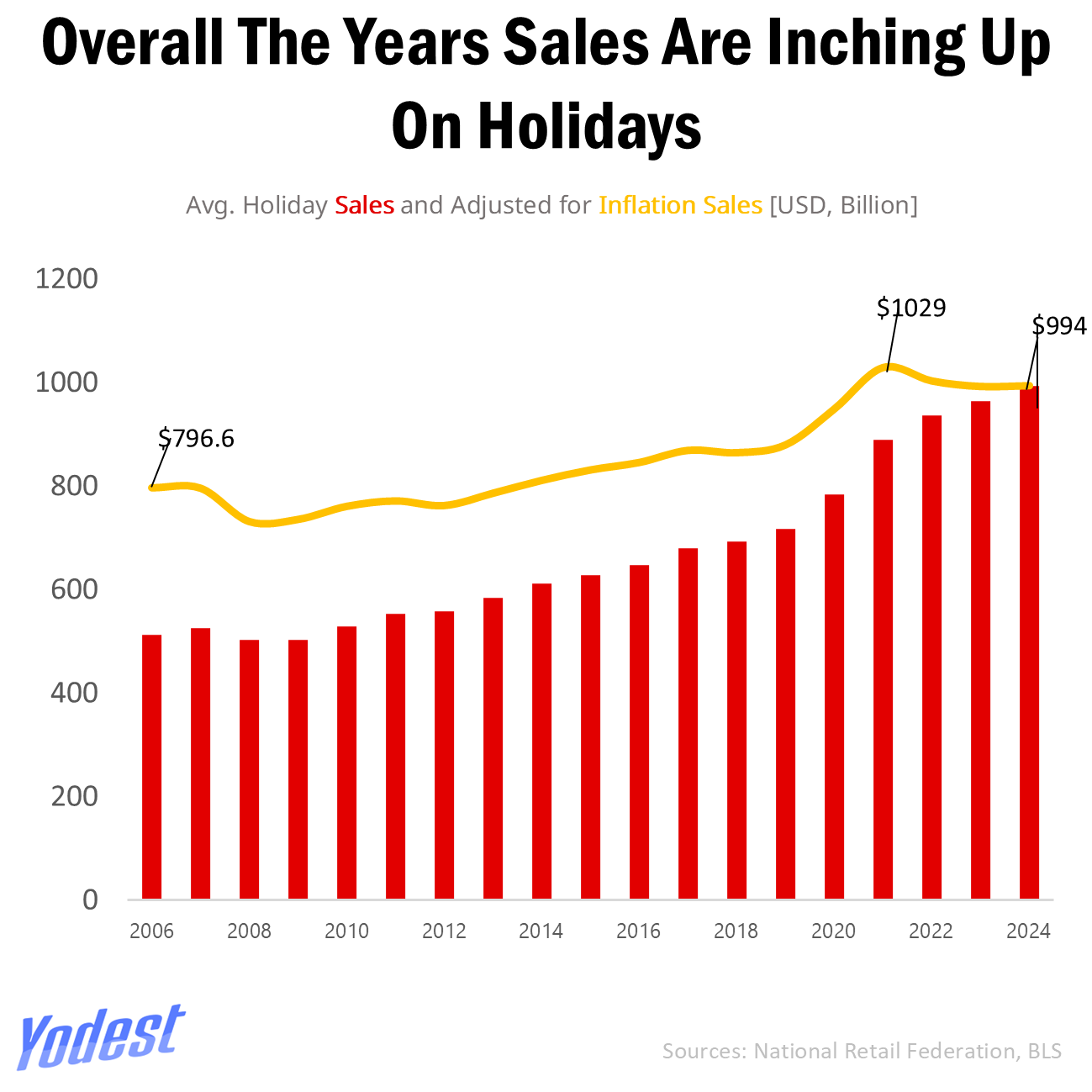

Even so, holiday spending in the U.S. has continued to climb over time irrespective of the financial crisis. The NRF reports that US holiday retail sales have increased every year since 2008, with 2024 sales totalling approximately $994.1 billion. That figure is more than double the $467.2 billion recorded in 2004. Compared with other countries, Americans also devote a large share of holiday spending to gifts. Among 24 countries tracked, the U.S. ranked second, with 69% of Christmas spending going toward gifts, only behind the UK at 70%.

NerdWallet's survey shows that US adults expect to spend a combined $242 billion on holiday gifts this year, averaging $1,107 per person, which is $182 more than last year.

How People Shop

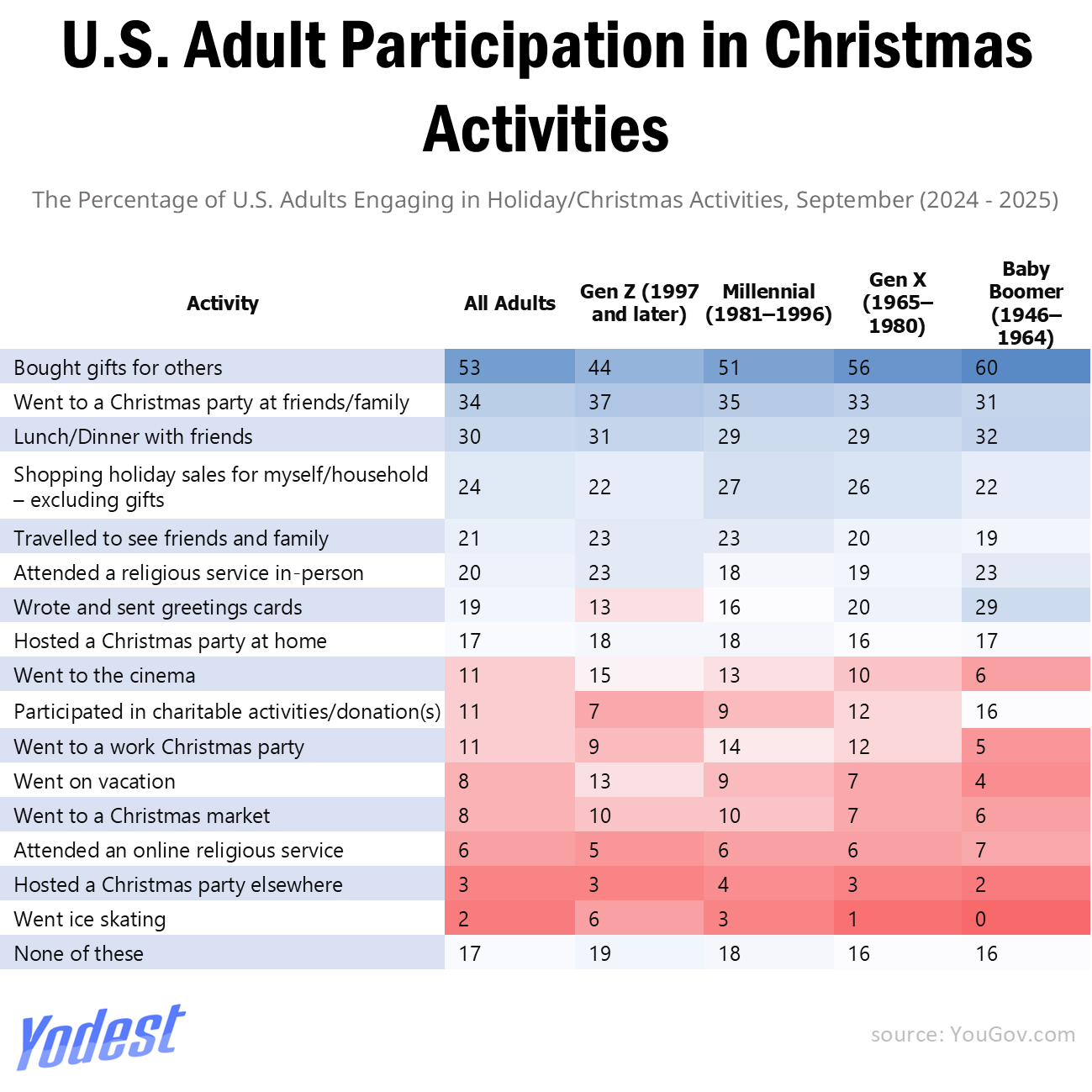

Shopping habits vary widely by age and platform. Around one-third of Americans, or 34%, wait until December to buy holiday-related items. Discount-hunting remains the most universal, about 79% of Americans actively look for holiday deals when buying gifts. Spending levels differ sharply by generation with Gen Z having the highest concentration of low spenders, about 37% spending under $100. Among Millennials, about 19% also spent less than $100 last year, while similar shares fell into the $199 to $299 ranges. Baby Boomers stood out as the biggest spenders, with 12% spending $1,000 or more on holiday gifts and showing up most frequently in stores.

Online shopping also plays a major role. Nearly half of shoppers, or 49%, buy gifts through their mobile phones. Millennials are the most likely to shop via mobile at 60%, followed by Gen Z at 50%. In-store shopping remains relevant among older consumers. About 59% of Americans bought holiday gifts in physical stores, rising to 63% among Gen X.

The After-Holiday Setback

When it comes to gift choices, Statista finds that money leads the list. Cash or transfers rank first at 36%, tied with clothing, textiles, and shoes at 36% vouchers and gift cards follow closely at 33%. The rankings also reflect consumers' choice on flexibility over fixed purchases. According to a survey 19% of shoppers are unsure how much to budget because of tariff-related costs and that between October-November, estimated gift budgets dropped by $229, the largest decline it has recorded at that point in the holiday season.

Despite financial pressure, credit remains the dominant way Americans pay for the holidays. Nearly three-quarters of shopper's plan to use credit cards, even as 31% of those who used credit last year say they have not fully paid off those balances, and 10% report carrying debt from multiple holiday seasons. Alternative financing is another way shoppers pay, as 18% of shoppers plan to use buy now, pay later services this year, with Gen Z leading adoption at 35%. As credit scoring models begin to factor in BNPL usage, the holiday season may leave longer-lasting financial effects than many consumers anticipate.

Taken together, there is a familiar pattern of how Americans continue to spend generously during the holidays, even as economic uncertainty grows.

BEFORE YOU GO

Not all news. Just the news that matters and changes the way you see the world, backed by beautiful data.

Takes 5 minutes to read and it’s free.